The tax avoidance measure dropped in Monday's mini budget would have meant significant costs and compliance charges, the federal government says.

The former Labor government introduced the tax law amendment to prevent multinational companies writing off some expenses, but the current Coaltion government said Treasury advised the amendment was unworkable.

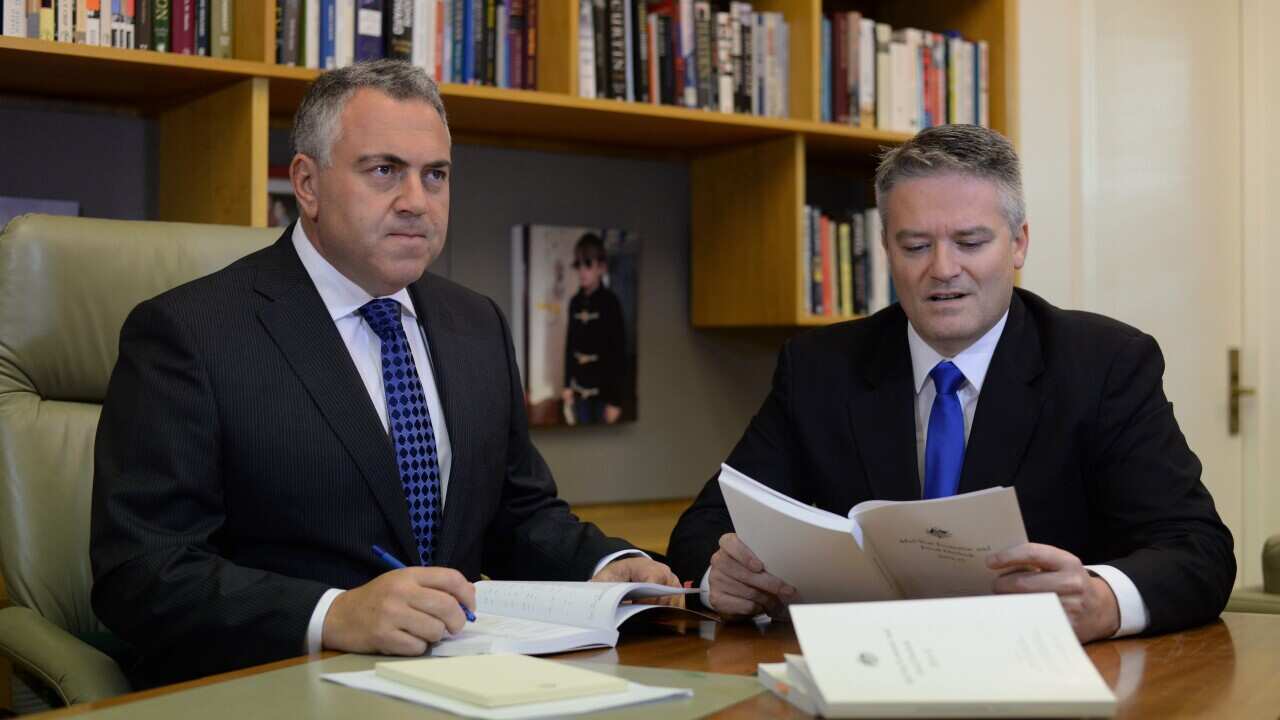

“The decision not to proceed with this aspect of Labor’s proposed law was not an ideological policy choice,” a joint statement from Treasurer Joe Hockey and Finance Minister Mathias Cormann said.

“It was a practical decision because the draft law could not be satisfactorily implemented.”

Opposition leader Bill Shorten said the government put the tax avoidance measure in the "too hard basket".

However, the government says it is still commited to ensuring the Australian Tax Office can share and access tax information with other tax bodies internationally by 2017.

The Tax Institute's Senior Tax Counsel, Robert Jeremenko, said tax laws around the world were not adequate to deal with the changing situation.

"Our tax laws ... are analouge tax laws in a digital world," Mr Jeremenko said.

While Australia's framework for preventing tax avoidance was robust, nations (including Australia) needed to rethink laws, he said.

Tax Justice Network Australia Secretariat Mark Zirnsak said the government could do more to combat multinationals with tax avoidance, but looked forward to the information sharing between tax bodies.

OECD takes swipe at Australia’s tax structure

Australia should move away from income and transaction taxes and raise the goods and services (GST) and land taxes, the OECD's 2014 economic survey of Australia says.

The nation’s income from the GST was low compared to other OECD nations, the survey said.

“Consequently, the tax burden falls more on other taxes, including those on labour and business,” the survey said.

The global economic crisis and associated stimulus, the decline in Australia’s resource sector, over-commitments, costly spending initiatives and tax cuts combined for what the OECD described as an unusual run of government debt deficits.

Share